Content

Hence, they are rudimentary from an accounting perspective and require to be treated correctly as per accounting standards. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. Since the copier is being depreciated, Tim will need to record the depreciation expense as well.

Therefore, to understand the bifurcation of office supplies and the respective categorization, it is important to understand the type of office supplies and their usage. Contingent on the categorization, they are treated in accordance as per accounting treatments. Office supplies are considered to be short-term assets on the balance sheet and will usually be classified as such. If the purchase amount for office equipment exceeds the threshold amount of $2,500 along with other criteria, you can use the depreciation account. If you buy these items regularly and keep consuming them, record them as an expense. Common examples of office supplies include printing paper, letter envelopes, ink cartridges, staplers, filing covers, and so on.

Alert: highest cash back card we’ve seen now has 0% intro APR until 2024

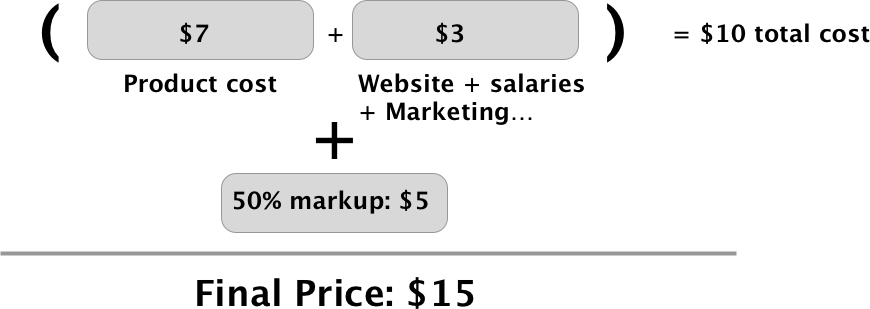

Small equipment purchases that are generally under $2500 can also be categorized here since they are not material. Consolidated Maintenance Capital Expenditures shall be calculated over the four fiscal quarters immediately preceding the date of determination thereof. Production Costs means those costs and expenditures incurred in carrying out Production Operations as classified and defined in Section 2 of the Accounting Procedure and allowed to be recovered in terms of Section 3 thereof.

Here are a few key points to remember when classifying office supplies. For partnerships and multiple-member LLCs, show these expenses in the “Other Deductions” section of Form 1065. You must attach a separate statement breaking down the different deductions included in this line item. It used to be that all business assets that cost more than $500 had to be depreciated. Depreciation is a way of spreading out the cost of a business asset over the life of that item. These expenses are used for the operations of the office, so they are often called “office operating expenses.”

Retail Clothing Business Financial Model – Case Study

Assets that can be liquified within a fiscal year are current assets whereas those that require over one fiscal year to be liquified are noncurrent assets. In order to have correct financial statements, businesses need to keep track of various items and transactions that are used by or carried out in the business. These records are usually made using journal entries in different ledgers such as the general ledger. When keeping track of transactions and items, it is important that the record made captures it in the right category as either income or expenditure or more accurately, as asset, liability, or equity. Thus, in order for us to effectively answer whether supplies are an asset, let us understand what both supplies and assets mean.

Tim determines that the salvage value of the copier will be $300, and it will be depreciated over three years using the straight-line method. Transform the way you do business with finance experts from Oak Business Consultant. A Long-term asset can be depreciated over its estimated useful life.

What Kind of Business Expense Is an Office Chair?

When recording a purchase as an asset, be sure to record both the purchase and the depreciation expense. However, Tim still needs to record the purchase of the copier, which is a fixed asset. Tim can choose to record both of these as assets, or he can choose to expense the printer immediately since it’s less than $2,500 and only record the copier as an asset. Here is the journal entry that needs to be made to record the printer purchase.

On the balance sheet, supplies itself is not a line item, instead, it is combined with other company supplies and merchandise inventory and recorded on the balance sheet as inventories. Hence, supplies on the balance sheet appear in the assets section under current assets as inventories. If however, the cost is significant, then, it will be recorded as supplies which is an asset account, and subsequently transferred to the supplies expense account once it is used up. Once supplies get used up, they no longer appear as assets on the company’s balance sheet, instead, they get recorded along with other expenses on the company’s income statement.

Video: Is supplies an asset?

For example, if you use the office copier and binder to produce a school report for your child, that’s personal use, and those costs should be kept out of your business tax filing. This means that the value of supplies stationery expense or asset on the balance sheet will decrease over time as they are used until they are eventually replenished or replaced. Supplies are items that a company uses in its operations but are not intended for resale.

What is a stationary expense?

Any costs you incur for general office supplies, such as paper for printing, pens, and envelopes, can be claimed as a stationary expense.

The cost of the supplies also plays a key role in its recording process because it can impact the company’s financial statements such as the income statement, balance sheet, and statement of cash flows. When the cost is significant, it gets recorded as assets first before it is expensed but in a situation where the cost is insignificant, it gets directly expensed. Hence, if supplies are not properly recorded, it could distort the information available to investors by giving them an incorrect impression of the company’s financial standing. When companies purchase supplies, it is recorded in the supplies account and is considered an asset.

Outstanding expenses in respect of the stationery items are shown in liabilities side of balance sheet. The closing stock of the stationery items can be reduced from the printing and stationery expenses at the time of finalization of accounts. The cost of manufacturing supplies on hand at the end of an accounting period will be reported in a balance sheet current asset account such as Inventory of Manufacturing Supplies.

- But things can be confusing when you’re trying to classify regular office expenses properly.

- These items are often used by businesses to drive revenue or by their employees to perform their daily tasks.

- This means supplies are items that are purchased to be used within a specified time frame.

- Yes, supplies are an asset on the balance sheet before it gets used up.

- Given that they are not that significant of investment in terms of finances, they are treated as non-capital expenses or operating expenses.

- An asset is anything owned by the company to provide economic value for the business.