And you’ll have a really good month, followed by 11 months of no revenue. For SaaS startups, gross margin is a crucial accounting metric to track because it indicates the efficiency and scalability of their business model. A high gross margin means that the startup is able to generate revenue from its products or services at a low cost, which makes it more profitable and sustainable in the long run.

Failure to follow these principles and standards can leave your business open to inaccurate financial health status and forecasts, which for the most part is destructive. FASB and IFRS joined hands to establish a new revenue recognition standard, called the ASC 606. Recognizing revenue before it’s earned will misinterpret your growth numbers, spiking up your growth potential. It is also important to know that this un-earned cash should not be invested in your future projects until it’s earned. There are two accounting methods, based on the timing of when the sale is recorded in the accounts.

The Problem with Spreadsheets for SaaS Accounting

While building accounting software, make sure you don’t have web servers with hard-coded values for server-to-server communication and database connection strings. Engineers have to be sure that individual application layers can scale by themselves without breaking the connection between layers to successfully make a high-performing system. A SaaS solution with a multi-tenant architecture can be built on a common infrastructure yet offer individual services to a wide customer base. In a multi-tenant environment, the data of individual tenants is strictly separated. To ensure this separation, the system needs to identify each tenant by an ID that is employed at the application and database layers and linked to individual users.

Best AI Finance Tools In 2023 – MarkTechPost

Best AI Finance Tools In 2023.

Posted: Sun, 20 Aug 2023 09:55:09 GMT [source]

The platform allows its users to build professional-looking invoices, capture expenses quickly, and see up-to-date financials at any time with online access. Many startups start tracking their finances using cash basis accounting. Cash accounting counts revenue as you receive cash and subtracts costs from that number once cash leaves your bank account. It is also good for small businesses or those with little inventory or customer base—but not recommended for SaaS businesses.

Best Practices when using SaaS Accounting

This guide comprises the basics and some not-so-basic concepts of SaaS accounting, to make the finance executive as well as the founder-who-doubles-up-as-an-finance-exec’s life easier. Here are the top 5 things to keep in mind when looking to build a SaaS accounting system. The system must be sufficiently capable of handling sensitive data, and this is possible if it offers a high level of security. After creating and launching an MVP, you can get feedback from early users of your SaaS application and think about which existing features to improve and which ones to develop from the ground up. Out of the box integrations with Synder provide you with better and faster operations.

SaaS customers pay subscription and add-on services fees, which require routine “maintenance” as customers upgrade, downgrade, or opt-in/out of different services. SAAS accounting is essential for any SaaS company because it provides accurate financial statements and insight into its operations to help make business decisions. Without accurate financial statements, making informed decisions about the company’s direction would be difficult. For a fast-growing SaaS startup, access to this information can make or break the company’s future. The COGS in a SaaS business typically includes costs related to hosting, server and network infrastructure, as well as personnel costs for customer service and billing expenses. To accurately calculate the gross margin, it is important to track and account for these costs appropriately.

For SaaS businesses, which rely heavily on financial projections to inform important business investments and decisions, working with accurate and up-to-date financials is crucial. While startups are not required to follow GAAP accounting principles, there are benefits to SaaS startups doing so from an early stage. Organizing your KPIs numerically helps track your performance against projections. At a high level, working capital is the difference between a company recognizes and expense or revenue and when it pays/collects the cash. Bookings really only matters for companies that are signing contracts with clients and then where there is a gap between when the contract is signed and the service period delivery begins.

- You’ll need to figure out step three first before allocating the transaction price.

- In essence, the ASC 606 guidelines help businesses recognize revenue consistently and ease the preparation of financial statements.

- If your business seeks an investment, having this in place will save time and effort restating financial information during these cycles.

- Also, it tracks stock, updates catalogs, and analyzes losses using an analytical system.

Instead, the business must wait until deliverables in the contract are fulfilled, then they run through a revenue verification procedure. Sunrise by Lendio is a complete accounting solution that’s powerful, yet easy to use. The online software provides top-tier bookkeeping tools and gives you the ability to manage your expenses, track cash flow, and gain direct access to business capital through Lendio. Xero is a powerful online accounting software solution that helps organizations run things smoothly, keep records tidy, and make compliance a breeze.

I personally can tell you, they’ve done a great job for our companies, including Calm.com. Working capital is one of the more challenging aspects of bookkeeping (and building projections) for subscription companies. Most VCs think of this metric as a quick and simple way to measure the health of a startup and is used by VCs to assess a SaaS company’s potential for scaling and profitability. Our entry-level package gives early-stage founders the accounting expertise they need. Startups are more successful when they can accurately budget and plan for growth.

How to Create a Reliable SaaS Accounting Solution: Core Characteristics, Architectural Components, and Features

An identified user gets full access to their data while having zero access to data of other users. When you develop accounting software, one of the first things to consider is that being web applications, SaaS products don’t maintain a defined local state. Therefore a shared database, with which the architecture can support no-touch elasticity, is critical. It’s difficult (if not impossible) to make an accounting system when web servers are configured with a local state. To efficiently tackle all these tasks, business owners, bookkeepers, and accounting professionals rely on dedicated solutions and services that leverage innovative technologies.

- On the other hand, a balance sheet outlines what a business owes and what it’s owed.

- Stampli is flexible enough for businesses of any size but still powerful enough for the enterprise.

- When you develop accounting software, one of the first things to consider is that being web applications, SaaS products don’t maintain a defined local state.

- Thriving in the tech industry is no easy feat for budding SaaS companies.

Keep in mind that every business is unique – so you may want to modify it to fit your specific business. The good news is that Kruze’s team is familiar with all flavors of Software as Service business models, and we can support your financials and metrics whether you sell to Fortune 500’s or to consumers. We are seeing plenty of slam-dunk seed rounds happening with SaaS startups that have $100k+ in ARR and good growth. However, this is significantly harder that the hot fundraising market of 2021.

Recognize the income generated by your business

SaaS accountants may be able to share names of past clients or talk you through how they’d set up your SaaS accounting software to track your financial metrics and revenue. Secondly, depending on the industry your SaaS caters to, it might make sense to find an accountant who understands that as well. For example, if you’re a SaaS for the medical industry, finding an accountant who’s worked with medical software companies before could be beneficial. If you’re working with investors, you’ll want an accountant who understands this financial process and knows how to handle the reports your investors will require. Ultimately, you’ll also want to choose someone that you can trust and work well with. Your accountant will be involved in the inner processes of your company, and you may spend a lot of time working with them, especially during tax season, so keep that in mind when you’re making your selection.

Various types of bookings include New Bookings, Renewal Bookings, and Upgraded Bookings. In the case of multi-year contracts, bookings that have at least one year’s committed revenue is considered as Annual Contract Value (ACV) Bookings. While ACV talks about annual amounts, Total Contract Value (TCV) Bookings are calculated taking into consideration the complete duration of the contract. Additionally, there are also non-recurring bookings that consist of one-time fees like set-up fees, training fees, and discounts.

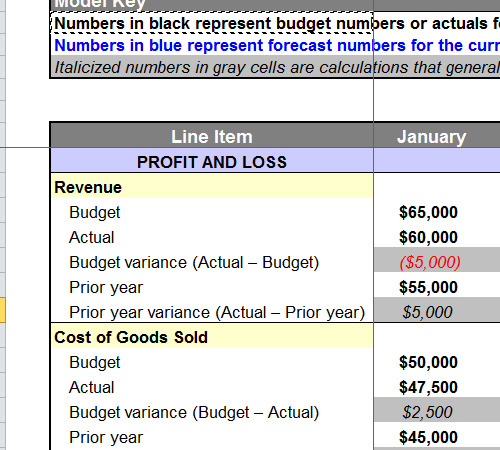

Further, entities may incur costs to develop software for their own internal use as well as for external sales to customers. Every month, SaaS accounting teams have to review accrued expenses and revenue to ensure they’re booked properly in the GL. And on the first of the next month, you have to reverse the accrual to maintain accurate records for the following period. But it’s notoriously tedious and difficult to manually review all accruals and ensure records are accurate when you generate financial statements.

An ordinary expense is one that is common and accepted in the trade or business. A necessary expense is one that is helpful and appropriate for the business. The IRS often has the edge in these disputes because the tax law spells out detailed rules about how these expenses must be verified and documented. The majority of states assess sales and use tax based on the location of the product being utilized. Therefore, making location as one of the most important factors in calculating a sales tax rate is the location of a sale.

Avetta Names SaaS Financial Expert as New CFO – DC Velocity

Avetta Names SaaS Financial Expert as New CFO.

Posted: Tue, 01 Aug 2023 14:51:15 GMT [source]

Building a sophisticated accounting and finance infrastructure that’s equipped to handle the rapid growth of your SaaS business is no easy task. It is, however, a necessary and entirely worthwhile step in your journey to becoming an established company. By following this framework, companies can create a more sustainable growth trajectory that’s equipped to meet the challenges of today’s macro environment. Given the emphasis most accounting platforms have on integration, your best option will likely be finding an accounting software you like that also integrates with the specific third-party plugins you need.

Stampli’s™ Accounts Payable Automation Software uses a powerful rules engine to automatically assign account codes, choose payment terms, and manage entire invoice process from creation to payment. GoCardless makes it simple to collect recurring and one-off payments from customers worldwide, via bank debit schemes such as ACH debit in the US. Adminsoft Accounts is developed by a small business owner for use by other small business owners.

Choosing the right accountant for SaaS businesses will depend on many factors. Here are a few things we recommend you ask about, regardless of whether you’re hiring someone to join your staff or will be outsourcing your accounting to a firm. First of all, make sure the new accountant or services firm you’re considering understands the SaaS financial business model and has worked with SaaS revenue recognition.

BlackLine automates complex, manual, and repetitive accounting processes in a unified cloud that enables accounting and finance teams to move beyond the legacy record-to-report process. With real-time access to financial data, clients can quickly drill into details to resolve issues and generate statements and disclosures to comply with multiple regulatory financial compliance requirements. The platform can handle bookkeeping, tax, and tax credits so organizations can focus on Saas accounting growing their business. The platform allows businesses to connect with customers and employees, get paid quicker, and have peace of mind knowing by keeping their books organized without losing time or money. It provides software and APIs, so businesses of all kinds can accept payments securely through its dashboard or mobile app. Exactly what this looks like will vary from business to business, but it begins with a solid understanding of your financial performance and KPIs.